The 3 AM Auditor: When Your Value Feels Like a Moving Target

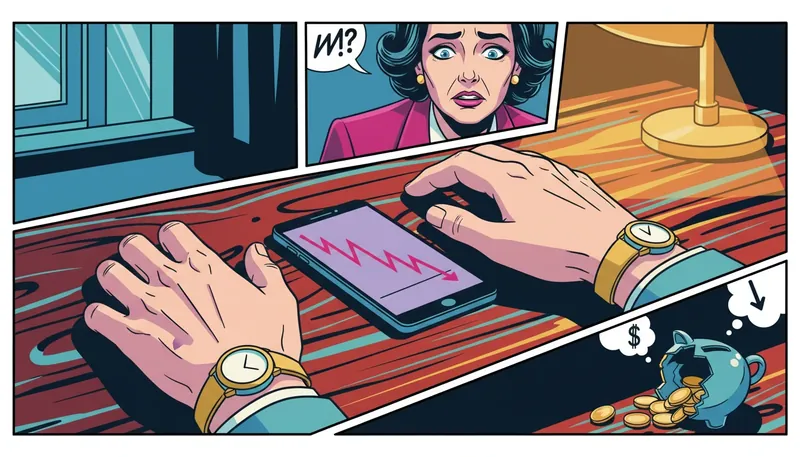

The ceiling fan spins a rhythmic, taunting blur above your bed, mirroring the circular logic of your own thoughts. It’s not just about the numbers in the bank account; it’s the visceral, gut-punch realization that a single missed deadline, a fumbled presentation, or a 'bad season' might have cost you a future you already mentally spent. This is the weight of financial performance anxiety psychology.

In high-stakes environments—whether you’re an athlete like Baker Mayfield navigating a contract year or a professional in a commission-based role—the line between who you are and what you earn begins to bleed. We’ve been conditioned to believe that our 'market value' is an objective measurement of our human value. But when that market fluctuates, the psychological toll is profound. We don’t just fear losing money; we fear losing our seat at the table of relevance.

This specific brand of stress creates a scarcity mindset that narrows our vision, making every decision feel like a survival-level threat. To navigate this, we must first look at the cold, hard reality of how we romanticize—and weaponize—the 'money on the table' narrative.

The Fear of 'Leaving Money on the Table'

Let’s be brutally honest: the 'market' doesn't care about your feelings, and your ego knows it. When critics whisper that you’ve 'cost yourself a lot of cash,' they aren't just talking about a missed bonus. They are attacking your status. In the world of high-performance contracts, financial performance anxiety psychology manifests as a relentless internal audit.

You start calculating the 'lost' potential instead of the actual reality. It’s a toxic form of accounting where you subtract your failures from your soul’s balance sheet. If you’re managing pressure of contract years, you’re likely hyper-focusing on every mistake as a direct withdrawal from your future security.

Stop romanticizing the 'what if.' The money you haven't earned yet isn't yours to lose. The psychological impact of losing money—or the perception of losing potential money—is often more damaging than the actual financial shift itself. You are currently obsessed with a phantom loss, and that obsession is exactly what’s degrading your current performance. You’re playing scared, and the market can smell fear a mile away.

Bridge: From the Reality Check to the Human Heart

To move beyond the sharp edges of market reality and into a space of true resilience, we have to look at the human being standing behind the contract. While Vix is right that the market is indifferent, your nervous system is anything but. Understanding why we feel this way is the first step toward reclaiming our peace.

Redefining Success Beyond the Contract

I want you to take a deep, grounding breath. Right now, your brain is trying to convince you that if you aren't 'at the top,' you are 'at the bottom.' But that’s a lie born from exhaustion. Financial performance anxiety psychology thrives on the idea that your worth is a fluctuating stock price. It’s not. It’s an unshakeable foundation.

Decoupling identity from salary is the hardest work you will ever do, but it is also the most rewarding. Think of your skills, your kindness, and your resilience as your true capital. Even if the numbers change, the person who earned those numbers is still there.

According to the American Psychological Association, money is a top source of stress, but that stress is often exacerbated by a lack of social support. You aren't just a producer of revenue; you are a friend, a partner, and a human being with inherent dignity.

Your worth isn't in what you bring home; it’s in how you show up for yourself when the world feels loud. You have permission to be more than a paycheck. You have permission to be imperfect and still be entirely enough.

Bridge: Translating Compassion into Strategy

While self-compassion provides the emotional safety net, we still live in a world that requires financial navigation. To truly resolve financial performance anxiety psychology, we must bridge the gap between feeling worthy and acting strategically. We need a plan that respects both our emotions and our bank accounts.

Creating a Financial Peace Plan

Strategy is the antidote to panic. If you are struggling with the stress of performance-based pay, you cannot rely on 'hope' as a financial plan. You need a framework that mitigates the power of financial performance anxiety psychology by removing the mystery from your future.

1. The 'Worst-Case' Audit: Write down the actual, literal worst-case financial scenario. Often, our anxiety lives in the vague 'gray area.' When you define the bottom, you realize you can survive it.

2. The Identity Diversification Strategy: Treat your self-esteem like a portfolio. If 90% of your self-worth is invested in 'Professional Income,' you are over-leveraged. Invest time in hobbies, community, and health where the 'ROI' isn't monetary.

3. High-EQ Communication: When discussing contracts or performance, use scripts that pivot away from desperation. Instead of 'I need this,' try: 'My track record shows X value, and I am looking for a partnership that reflects that trajectory.'

Financial stress management for professionals isn't about ignoring the money; it’s about managing the risk of your emotional reaction to that money. By building a 'Peace Plan'—which includes emergency funds and career pivot options—you regain the upper hand. You stop being a victim of the market and start being a strategist of your own life.

FAQ

1. How can I stop my salary from defining my self-worth?

Decoupling identity from salary requires intentional 'Identity Diversification.' Engage in activities where performance is not measured by money, such as volunteering or creative hobbies, to remind yourself that your value exists outside of a professional context.

2. What are the symptoms of financial performance anxiety?

Symptoms of financial performance anxiety psychology include chronic insomnia, hyper-fixation on small mistakes, a scarcity mindset (fear of spending even when you have funds), and feelings of shame or worthlessness tied to career setbacks.

3. How do I manage the stress of a contract year or commission-heavy job?

Focus on 'Process over Outcome.' By setting daily goals that are within your control (e.g., number of calls made or hours practiced) rather than focusing on the final financial result, you reduce the psychological load of performance-based pay.

References

apa.org — Financial Stress - APA

psychologytoday.com — The Psychology of Money - Psychology Today

joebucsfan.com — Baker Mayfield’s Contract Impact - JoeBucsFan