The Sticker Shock of Scandal

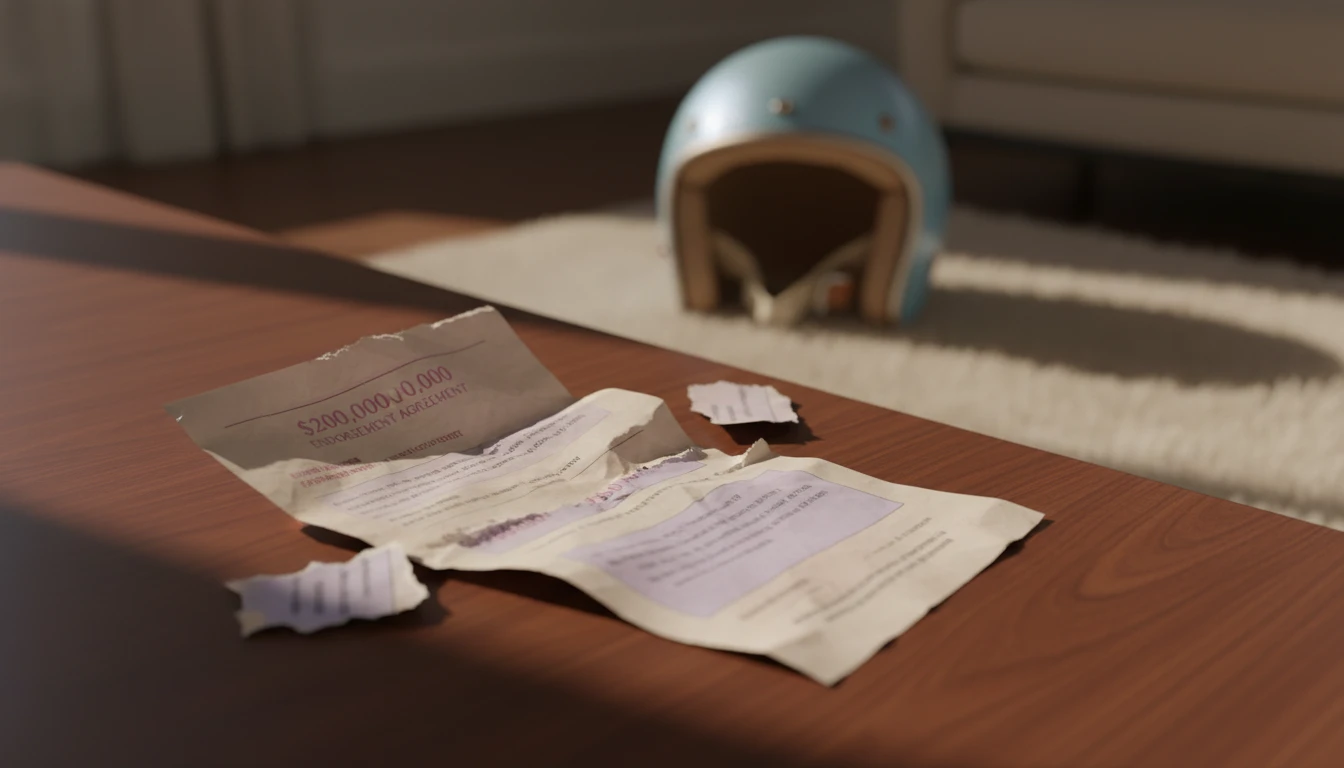

Let’s just name the feeling. It’s that sense of moral whiplash you get when you see a headline about a public figure’s personal failings followed by an eye-watering number with a dollar sign in front of it. You read about deception, misconduct, and a spectacular fall from grace, and in the next breath, you’re reading about millions of dollars in a potential payout. It feels fundamentally... off.

That feeling is completely valid. It’s the dissonance of seeing deeply unethical behavior tangled up with the kind of money most people will never see. It can make you feel like the whole system of high-level college football finances is rigged or just plain incomprehensible. That’s not ignorance; that’s your internal sense of fairness firing off an alarm bell. And you’re right to feel it. That initial shock is the entry point to a much deeper, more complex financial story.

To move beyond that feeling of disbelief into genuine understanding, we have to set the emotion aside for a moment—not to discard it, but to equip it with facts. We need to look at the cold, hard mechanics of the contracts that govern these empires. Let's peel back the layers of legalese to understand how a massive potential liability, like a Bobby Petrino contract buyout, can vanish into thin air.

The Contract's Escape Hatch: What 'For Cause' Really Means

Alright, let's cut through the noise. People hear 'buyout' and think it's guaranteed money. It's not. Every one of these multi-million dollar NCAA coaching contracts has an escape hatch, and it's called a 'for cause' termination clause. It’s the university's kill switch.

Think of it this way: the contract protects the coach, but the 'for cause' clause protects the institution. It essentially says, 'We will pay you millions if we fire you for losing games. We will pay you nothing if you publicly embarrass the brand and violate the terms of this agreement.' And Bobby Petrino's exit from Arkansas is the textbook example.

When the details of his motorcycle crash and his affair with a subordinate he'd hired came to light, the university didn't just have a PR nightmare; they had a legal pathway. Petrino hadn't just lied; he had, in the eyes of the university, committed a material breach of his contract. As a result, that colossal $18 million buyout evaporated. He was fired for cause, and the athletic department's finances were protected from a catastrophic payout. This wasn't a negotiation; it was the morality clause enforcement that every college president prays they have when scandal hits. The Bobby Petrino contract buyout that never happened is a brutal lesson in contractual power dynamics.

The Modern Playbook: How Universities Mitigate Risk Today

Now that Vix has shown us the defensive weapon, let's talk strategy. Athletic departments operate like corporations, and their primary goal is risk management. The Bobby Petrino situation at Arkansas, along with other high-profile scandals, fundamentally changed the game for NCAA coaching contract details. It’s no longer just about wins and losses; it’s about protecting the institution from the immense financial and reputational damage a rogue coach can inflict.

Here is the modern strategic approach:

1. Ironclad Morality Clauses: These are no longer boilerplate. Contracts now include highly specific language that covers not just illegal acts, but acts that bring 'public disrepute, contempt, scandal, or ridicule' to the university. This gives the institution maximum leverage.

2. Proactive Buyout Mitigation: Instead of a simple lump sum, buyouts are often structured with offsets. If a fired coach gets another job, their new salary reduces the old university’s payout obligation. This prevents a coach from 'double-dipping' and incentivizes them to get back to work.

3. Guarding Against Loss of Donor Support: This is a crucial, often overlooked factor. A major scandal can cause donors to pull millions in funding. Modern contracts are designed to give the university a swift, financially clean exit precisely to reassure donors that the institution's integrity is being protected. The cost of hiring new staff is nothing compared to the potential loss of major gifts.

Ultimately, understanding the dynamics of a Bobby Petrino contract buyout isn't just about one man's scandal. It's a masterclass in high-stakes risk management. The shocking numbers are part of a calculated financial system designed to protect massive institutions. The real story isn't just in the headlines of the crash, but in the meticulously crafted fine print of the contract.

FAQ

1. Why didn't Arkansas have to pay Bobby Petrino's $18 million buyout?

Arkansas avoided the buyout by firing Bobby Petrino 'for cause.' They determined that his actions—misleading the university about his motorcycle crash and his inappropriate relationship with an employee—constituted a significant breach of his contract's morality clause, thus voiding the university's financial obligation.

2. What does 'fired for cause' mean in a college football coach's contract?

Being 'fired for cause' means an employee is terminated for a serious breach of contract, such as illegal activity, dishonesty, or actions that bring the employer into disrepute. In this context, the employer is not required to pay the severance or buyout amount stipulated for a standard termination (e.g., for poor performance).

3. How have NCAA coaching contracts changed since the Bobby Petrino scandal?

Since high-profile scandals, NCAA coaching contracts now include much more specific and stringent 'morality clauses.' They also feature more complex buyout mitigation terms, such as salary offsets, to reduce the financial liability of the university if a coach is fired and takes another job.

4. What is a morality clause in a coaching contract?

A morality clause (or 'morals clause') is a contractual provision that allows an employer to terminate an employee for certain behaviors, even if they occur outside of work. In coaching, this is designed to protect the university's reputation from damage caused by the coach's personal conduct.

References

nbcsports.com — Arkansas fires football coach Bobby Petrino for cause, won't pay $18M buyout

en.wikipedia.org — Bobby Petrino - Wikipedia