The Silent Ledger: When Money Becomes a Third Party

It starts with a soft glow from a smartphone at 11:30 PM, the blue light illuminating a face etched with the specific exhaustion of a late-night bank statement scroll. You aren't just looking at numbers; you are calculating the distance between your current balance and next week's groceries, all while your partner sleeps soundly beside you, unaware of the internal spreadsheet running in your mind. This is the visceral reality of financial stress, a weight that doesn't just sit in your wallet, but settles into the marrow of your marriage.

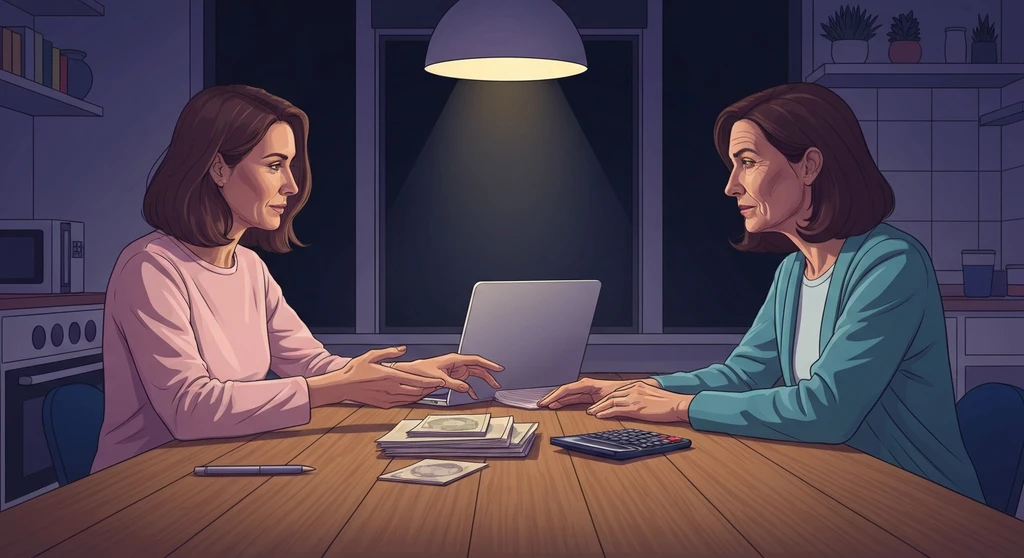

Financial stress in marriage communication isn't always about the lack of funds. Often, it is about the lopsided distribution of the cognitive energy required to track, predict, and worry about those funds. When one person carries the map while the other just sits in the passenger seat, the driver eventually burns out. To address this, we must look beyond the 'how much' and interrogate the 'how'—how we talk, how we share, and how we acknowledge the labor of household financial planning stress.

The Mental Load of Money: Why Budgeting is Emotional Labor

Let’s look at the underlying pattern here. When we talk about money arguments in marriage, we are rarely debating the price of milk. We are debating executive function and the invisible labor of anticipation. In many relationships, one partner becomes the default 'Chief Financial Officer,' a role that requires constant hyper-vigilance. This isn't random; it's a cycle where the more one person manages, the less the other feels they need to know, leading to a profound sense of isolation for the manager.

According to research cited by Psychology Today, money is a leading cause of divorce precisely because it touches on our core needs for security and autonomy. When you are the only one tracking the autopays, you aren't just 'good with math'—you are the sole guardian of the family’s safety. This creates a power imbalance that breeds resentment.

The Permission Slip: You have permission to stop being the sole architect of your financial future. It is not 'unkind' to demand that your partner shares the cognitive burden of money management for couples; it is an act of relationship preservation.Calming the Financial Anxiety: Moving from Panic to Partnership

To move beyond the cold logic of the spreadsheet and into the warmth of understanding, we have to acknowledge how financial anxiety in relationships actually feels in the body. It’s that tightness in your chest when the credit card notification pings, or the way your voice gets small and sharp when you ask, 'Did you really need to buy that?' That isn't bitterness; it's your nervous system trying to protect your home. It’s a brave desire to be safe.

When things get heated, remember that your partner’s avoidance of the budget might not be laziness; it could be their own form of financial anxiety. They might feel deep shame about not 'providing' enough or fear the conflict that comes with the truth. Before you dive back into the numbers, take a deep breath together. Reassure each other that you are on the same team. You aren't fighting each other; you are both fighting the stress. Your worth is not a decimal point, and your marriage is the safe harbor where you both get to be human, mistakes and all.

Designing a Shared Financial System: The Strategy for High-EQ Success

Now that we’ve addressed the emotional landscape, let’s talk about the move. To eliminate the friction of financial stress in marriage communication, we must move from passive observation to active strategizing. Sharing financial responsibility isn't about having a two-hour fight every Sunday; it's about building a system that automates the mundane and clarifies the complex.

Here is the play for budgeting together effectively:

1. The Monthly Money Audit: Schedule a 20-minute 'state of the union' where you review the previous month. No blame, just data.

2. The High-EQ Script: If you feel the load is too heavy, say this: 'I’ve noticed I’m carrying the full weight of tracking our expenses, and it’s making me feel disconnected from you. Can we spend 15 minutes on Sunday looking at the accounts together so I don’t feel so alone in this?'

3. Decentralize the Data: Use a shared app or a joint spreadsheet. If the information is only in one person’s head, it’s a burden. If it’s on a screen you both can see, it’s a project. Move your household financial planning stress into a digital space where visibility is 50/50.

FAQ

1. How do I bring up financial stress without starting a fight?

Start with 'I' statements and focus on your feelings of overwhelm rather than your partner's spending. Frame it as a desire for more partnership and shared security rather than a lecture on their habits.

2. What if my partner refuses to participate in budgeting?

Identify the barrier. Is it boredom, or is it fear? Offer a low-stakes entry point, such as simply looking at one account together for five minutes, to build the habit of financial transparency without the pressure of a full overhaul.

3. Should we have separate or joint bank accounts to reduce stress?

There is no one-size-fits-all, but many couples find success with a 'Yours, Mine, and Ours' approach. This allows for shared responsibility for bills while maintaining personal autonomy and reducing the 'policing' of small daily purchases.

References

en.wikipedia.org — Financial Stress - Wikipedia

psychologytoday.com — The Stress of Money on Marriage - Psychology Today